Final Business Week of 2024 Ends with a Whimper as Energy Prices Continue Downwards

Energy markets are ticking lower to start the day as we wrap up the last full business week of the year. After going 5 for 5 with gains last week, RBOB futures are on pace for 5 straight down days this week, setting up a potential test of the 3 year lows around $1.85 as we approach the new year. ULSD futures are leading the selling this morning, but have fared better overall this week, and don’t look quite as bearish on the charts.

Next week, NYMEX contracts will stop trading and settle early on Tuesday afternoon, and will be closed along with all other markets on Christmas day. Thursday and Friday will be standard trading days for futures and spot market assessments, but liquidity will be very thin.

November’s Personal Consumption Expenditures (PCE) readings, a favorite indicator of inflation by many (including some at the Federal Reserve) came in at 2.4% for the year, and 2.8% when you exclude food and energy thank to the pull lower from gasoline and diesel prices over the past 12 months. That reading was slightly lower than several published guesses, which has helped equity futures tick higher from their overnight lows, while energy contracts seem to have ignored the report.

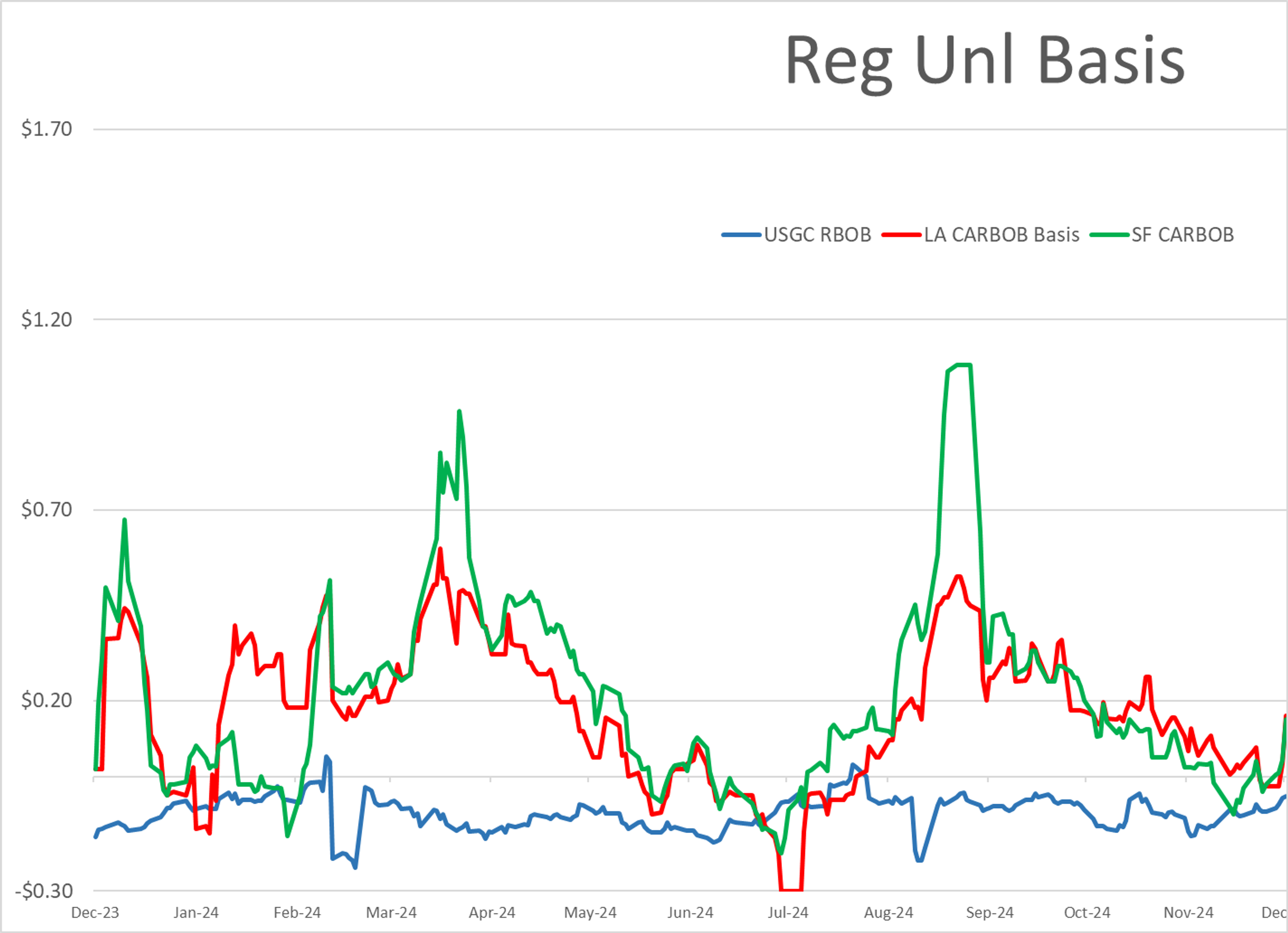

Speaking of lower gasoline prices, the California Energy Commission is taking credit for lower prices in the state this year, saying that its new efforts at forcing reports on all industry participants helps to account for a 20 cent drop year on year. That press release did not mention why California’s average retail price comes in at $4.21/gallon today while US Gulf Coast states are paying just $2.66 on average.

Unfortunately for the commission, they patted themselves on the back right in the midst of a 20 cent basis rally for CARBOB prices in the LA spot market after Chevron had the nerve to have a refinery breakdown without telling regulators first. San Francisco spot prices are rallying in sympathy with LA, with those prices up roughly 15 cents so far this week, during what is typically one of the weakest stretches of the year for differentials.

Latest Posts

Energy Market Rallying With US Sanctions On Russia's Energy Industry

Energy Market Rallying With US Sanctions On Russia's Energy Industry

Economic Fears Becoming Most Important Story Of 2025

Week 10 - US DOE Inventory Recap

Energy Futures Dipping Lower

Petroleum Complex Maintaining Modest Uptick In Energy Futures

Social Media

News & Views

View All

Energy Market Rallying With US Sanctions On Russia's Energy Industry

Energy Market Rallying With US Sanctions On Russia's Energy Industry