Petroleum Complex Maintaining Modest Uptick In Energy Futures

The petroleum complex is ticking modestly higher for a second day, searching for a bottom after reaching multi-month lows to start the week. Stock markets are pointed higher this morning following another big selloff Tuesday, as the tariff whiplash continues with cooler heads apparently prevailing temporarily in the U.S./Canada trade war.

Energy futures so far seem to be shrugging off the potential for a cease fire in Ukraine as Russia seems to not be ready to play ball. Other reports suggest that the U.S. has already been lax in enforcing the sanctions put in place by the previous administration leading to a surge in Russian petroleum exports.

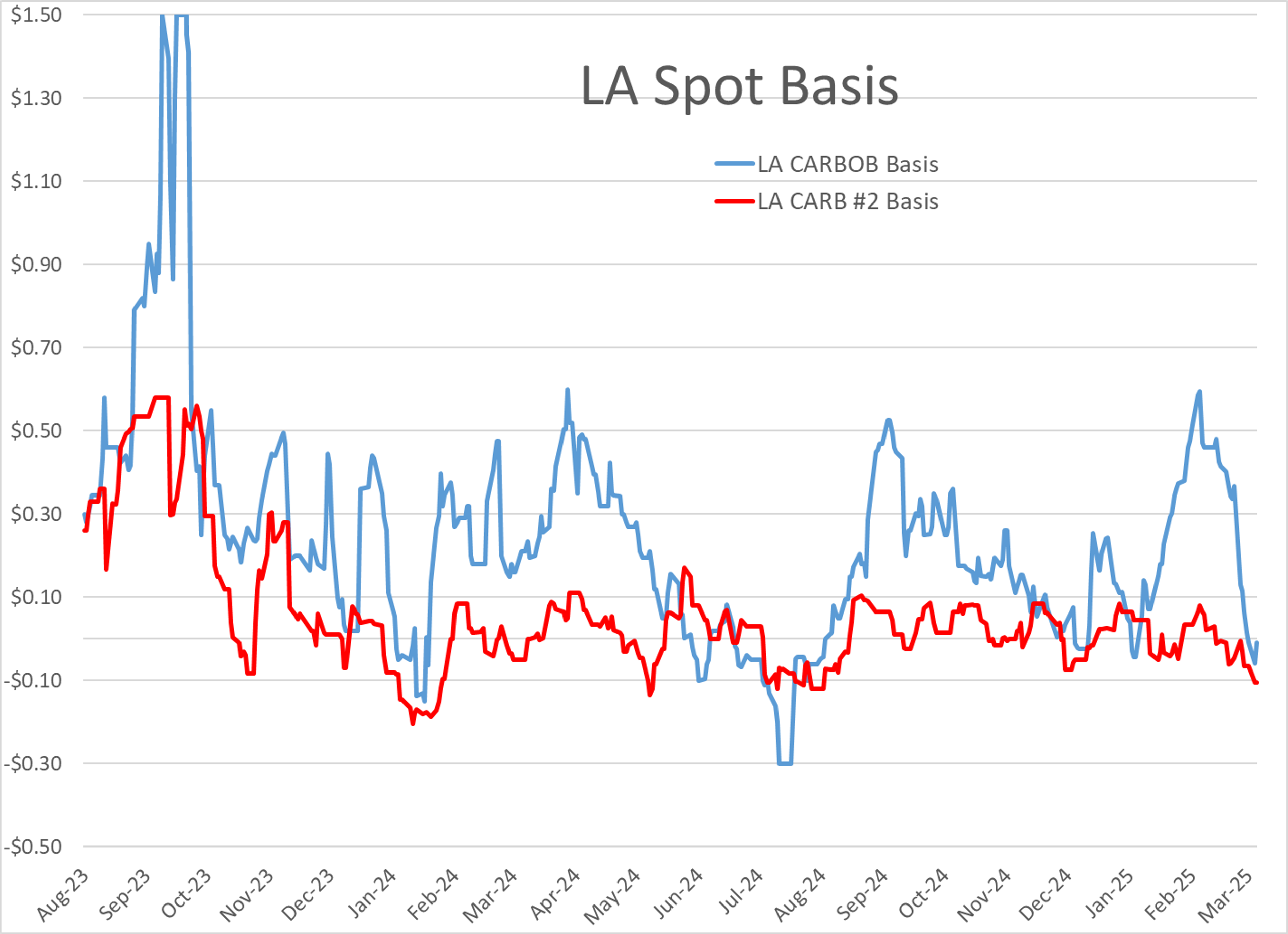

P66 reported unplanned flaring at is LA-area refinery overnight, with "Start up/Shut Down" reported as the cause suggesting a hiccup with scheduled maintenance at the facility. LA Spot differentials had been under heavy selling pressure in recent weeks as imports rushed to meet the state's supply shortfall with both CARBOB and CARB Diesel basis values reaching 8 month lows, and so far multiple reports of issues at Chevron's El Segundo facility in the prior week hadn't stemmed the tide of selling, so we'll see if the P66 news is enough to turn the tables.

The API estimated that US Gasoline stocksdropped by 4.6 million barrels last week as refiners move through the seasonal RVP transition, while diesel inventories saw a small build of around 400,000 gallons. The EIA's weekly report is due out at its normal time today.

Yesterday's Short Term Energy Outlook published by the EIA predicted that global oil markets will remain tight in the front half of the year, but will shift to building inventories in in the back half of the year as OPEC's production cuts unwind. The outlook did not include impacts of potential tariffs on Canada and Mexico since those are on hold for now, but did include tariffs on China. The STEO predicts that increasing consumption and lower refining capacity would both lead to tighter diesel markets in the U.S., with an 8% drop in inventories predicted for 2025. OPEC's monthly report is due out later this morning.

Latest Posts

Energy Futures Rally To Recover While Trade Wars Continue

Energy Markets Modestly Higher

Energy Futures Rally on Tariff Delay but Weekly Losses Loom

Energy Markets Searching For Bottom Reaching Multi-Month Lows

Week 9 - US DOE Inventory Recap

Energy Markets Facing Wave Of Heavy Selling

Social Media

News & Views

View All

Energy Futures Rally To Recover While Trade Wars Continue

Energy Markets Modestly Higher