Futures Drift Lower in Abbreviated Juneteenth Session

US stock markets and banks are closed for the Juneteenth holiday, and while NYMEX energy futures are trading in an abbreviated session, there is no settlement today, and spot markets around the country aren’t being assessed.

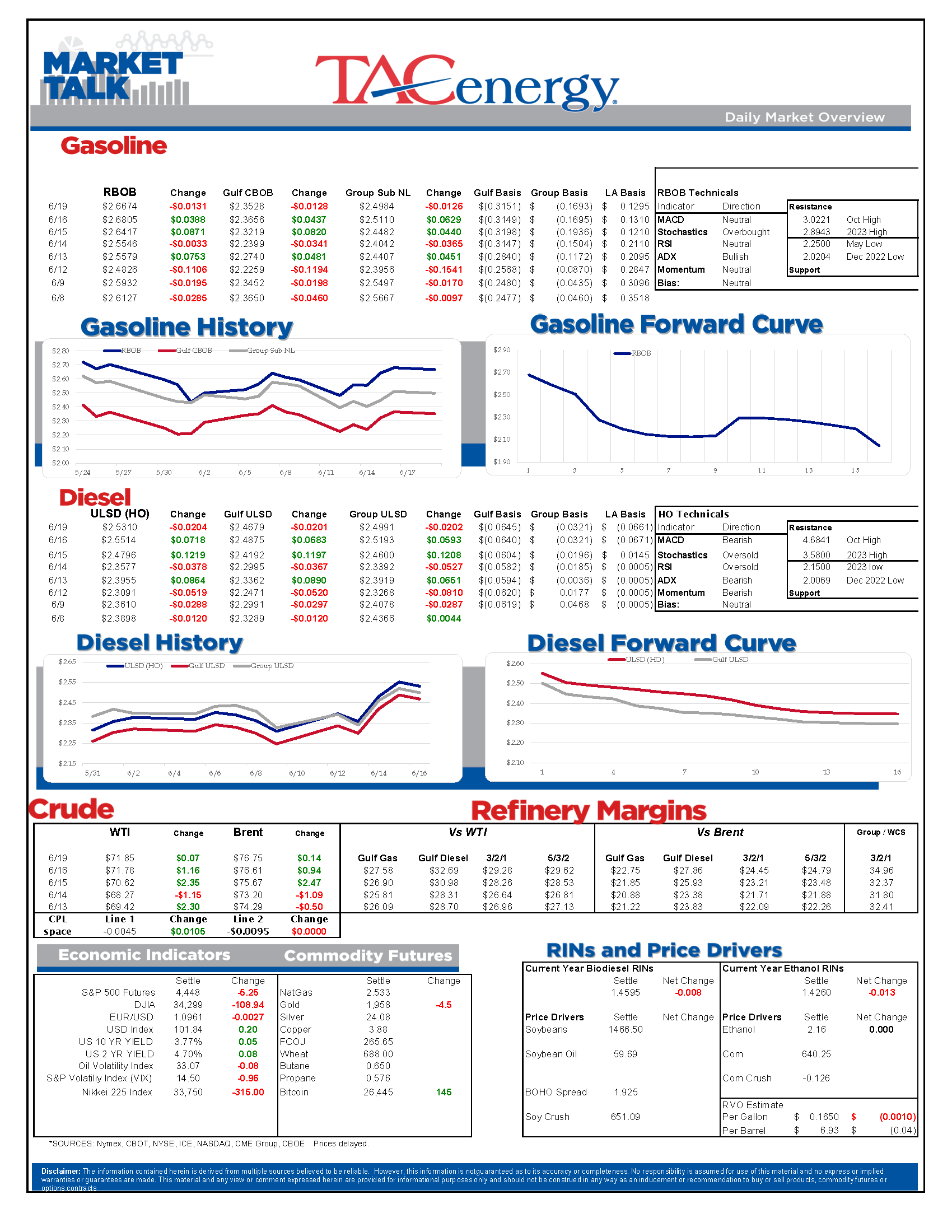

We’re seeing a small pullback in refined product prices after ULSD futures rallied to a 2-month high, while oil prices are seeing small gains in very quiet trading as most market participants in the US have taken the day off. Futures will halt trading at 1:30 eastern, with all trades done today included in Tuesday’s activity.

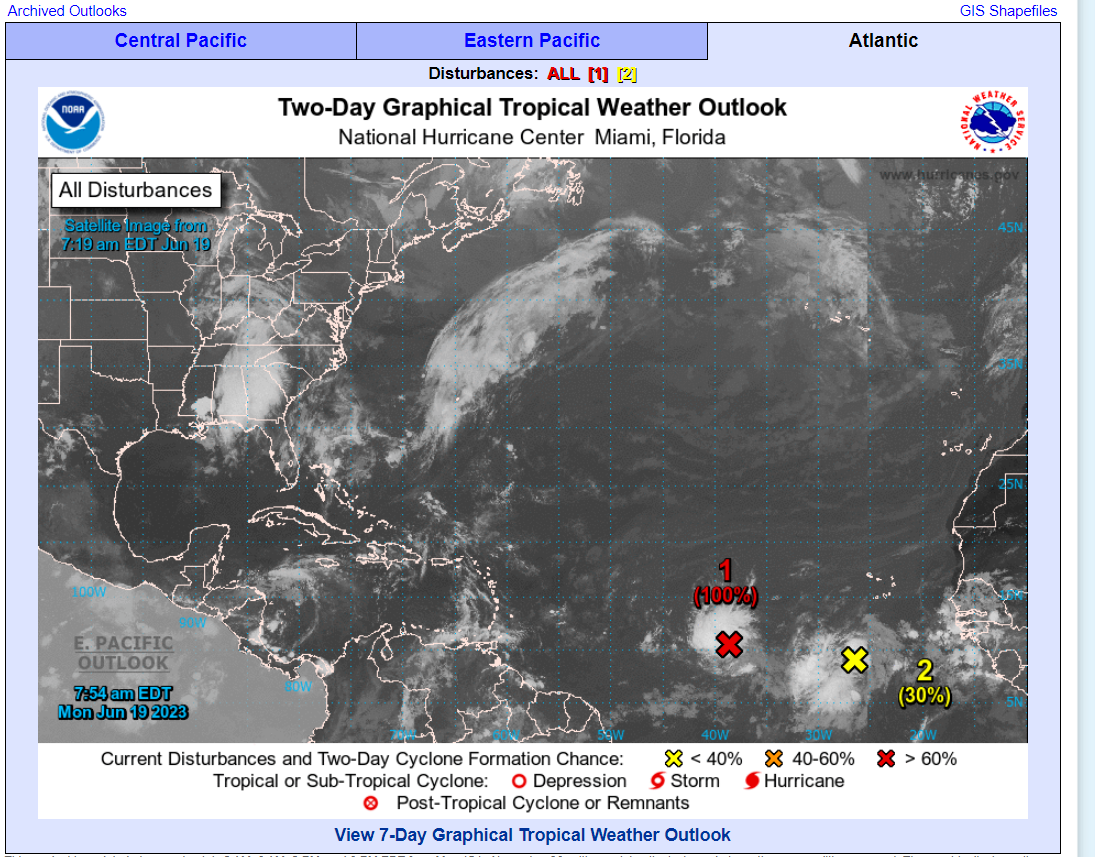

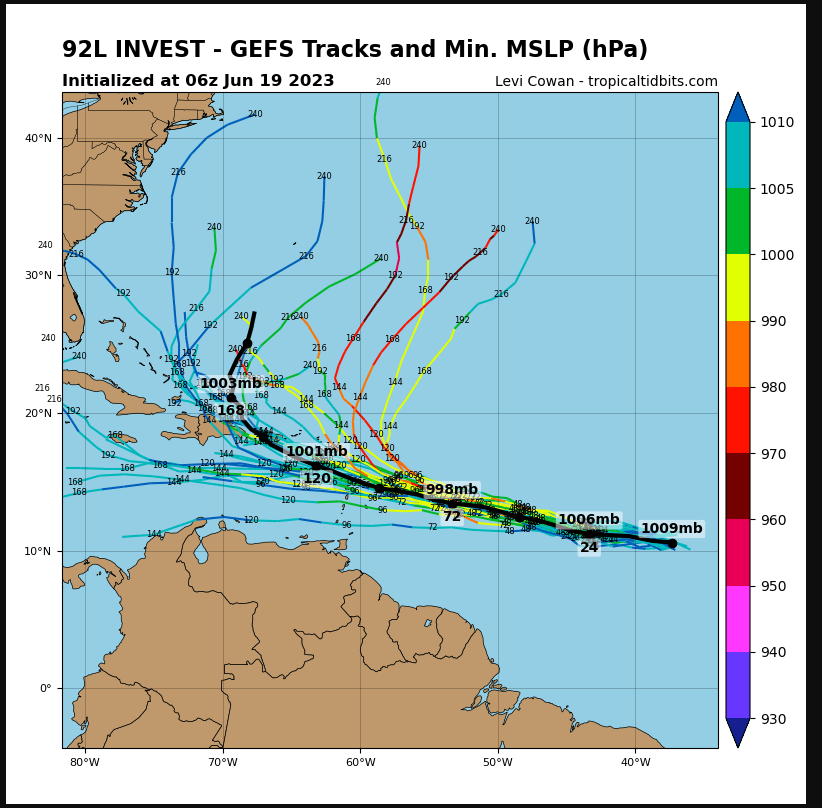

The national hurricane center is giving a 100% chance that the storm system churning across the central Atlantic will be named in the next two days and is giving 40% odds of a 2nd storm just behind the first forming over the coming week. Most early model runs keep the first storm out to sea as it turns north later this week, but there are still some forecast tracks that have it heading towards the East Coast, so we’ll need to keep an eye on it.

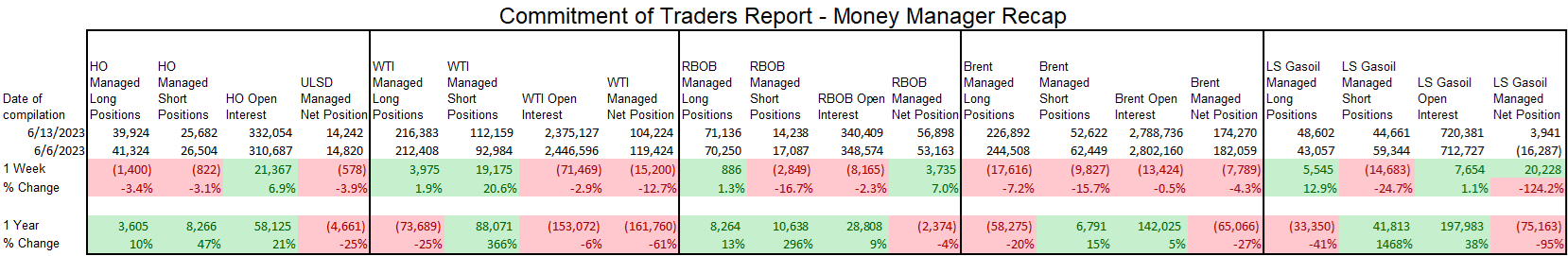

Money managers were cutting back their bets on higher oil and diesel prices last week, meaning many missed out on the late week rally. Gasoline saw a tick higher in net length held by large speculators, driven by a heavy round of short covering.

Baker Hughes reported more declines in drilling activity with the oil rig count dropping by 4, and the natural gas rig count dropping by 5.

Click here to download a PDF of today's TACenergy Market Talk.

News & Views

View All

Energy Markets Are On Storm Watch This Morning As Most Of The Industry Takes The Day Off

Energy markets are on storm watch this morning as most of the industry takes the day off, and financial markets digest a weaker Jobs report and the worst defeat by British conservatives in 248 years.

Refined products were trading a penny lower Friday, despite a shift north and east in Beryl’s projected path that puts a strike on the country’s busiest energy port (Corpus Christi….not Houston) in play while some models also have the storm hugging the Texas coast as it moves north and east which would put many more refineries and oil rigs in the storm’s path and no matter the damage it does or doesn’t do, it’s certainly going to disrupt import and export traffic over the coming week. Most refined product traders have the day off today since cash markets aren’t being assessed, but don’t be surprised if futures turn around later in the morning as this new risk reality sets in, particularly given how much flooding parts of the state have already seen this year even before dealing with a tropical storm.

With the unfavorable shift in the storm’s path for oil producers and refiners, expect a quick move to evacuate non-essential personnel from Gulf of Mexico oil rigs starting today, and we’ll likely see at least the 3 Corpus Christi area refineries pull back on their run rates over the weekend to avoid the extra damage that can occur if they’re knocked offline while running full out. Models now seem to be agreeing that wherever the storm finally makes landfall, it will move inland starting Monday and dump heavy rains across Texas for potentially two full days before heading north and east to dump rain on the population centers in the North Eastern US late next week. At this point the storm is predicted to be a category 1 hurricane at landfall, but don’t be surprised if that scale increases over the weekend.

The June payrolls report estimated 206,000 jobs added in June, while prior month estimates were slashed by 111,000 jobs, suggesting the labor market isn’t quite as strong as previously thought. Political conspiracy theorists will also note the statistical impossibility of the BLS revising 24 of the past 25 estimates lower. The official unemployment rate ticked up to 4.1% while the less manipulated U-6 unemployment rate held steady at 7.4%.

Markets largely shrugged off a huge 12-million-barrel decline in crude oil inventories Wednesday as the DOE continues to struggle with its accounting methods, showing a huge decrease in its oil adjustment factor on the week. Refiners cranked up run rates across all 5 PADDs last week, taking advantage of the pre-holiday surge in demand and shrugging off weaker margins. Between the storm in the Gulf Coast and the heat wave targeting California, it’s likely that we’ll see run rates cut back in the July 17 report, as next week’s data is compiled based on data reported today before those impacts are felt.

Week 26 - US DOE Inventory Recap

Refined Products Have Pulled Back A Nickel After Reaching 2-Month Highs Tuesday Morning

Refined products have pulled back a nickel after reaching 2-month highs Tuesday morning as the odds of Hurricane Beryl making a direct hit on the Gulf Coast oil production and refining zones have been reduced in the past 24 hours.

The European Forecasting model, which has been more accurate than the US model over the past decade, now has the storm making landfall on the NE coast of Mexico early next week, with low odds of a shift to the east that could put Corpus Christi in the crosshairs. The US GEFS model meanwhile keeps the storm over the Gulf of Mexico with a landfall as far east as Lake Charles LA looking possible.

The path of the storm will also matter a great deal for the eastern half of the US next week as the potential for very heavy rain increases from TN to New England the further north and east it moves as it approaches the US. One thing both models agree on is that this storm will not regain major hurricane strength after crossing the Yucatan peninsula Friday, although we’ve seen the past couple of years that the models also seem to struggle to account for the record-warm water temperatures, so don’t be surprised if the actual storm strength surpasses these forecasts next week.

Reminder that spot markets in the US won’t be assessed Thursday or Friday this week. NYMEX contracts will trade in an abbreviated session tomorrow (no settlement) and a normal session with a settlement Friday, so many rack postings around the country may change even though spot markets won’t. US Banks are closed tomorrow and open Friday. British banks are open both days.

The API reported a large draw of more than 9 million barrels of crude oil in the US last week, while gasoline stocks increased by 2.5 million and distillates dropped by 740,000 barrels. The DOE’s weekly report is due out at its normal time today, and since the Federal Holiday is tomorrow, it will not delay next week’s report which is based on forms submitted by refiners, pipelines and terminal operators due every Friday.

The DOE announced the 5 companies that were awarded gasoline in its liquidation the NE gasoline strategic reserve. BP, GE Warren, Vitol, Freepoint and Irving Oil were the only 5 companies that bid on the fuel and all 5 were awarded. The average price of the sale was $2.34/gallon, about 27 cents below the current value of RBOB in the NYH market. The DOE said this sale would lower gasoline prices for American consumers, and currently prices are up about 15 cents since the auction was announced in May.

The EIA this morning published a look at how energy use in the US has changed in the past 250 years. It shouldn’t surprise anyone still reading this that biofuels have seen a tremendous increase in recent years, but you might be surprised to know that they only recently surpassed wood for the top spot in renewable fuel consumption.

Click here to download a PDF of today's TACenergy Market Talk.