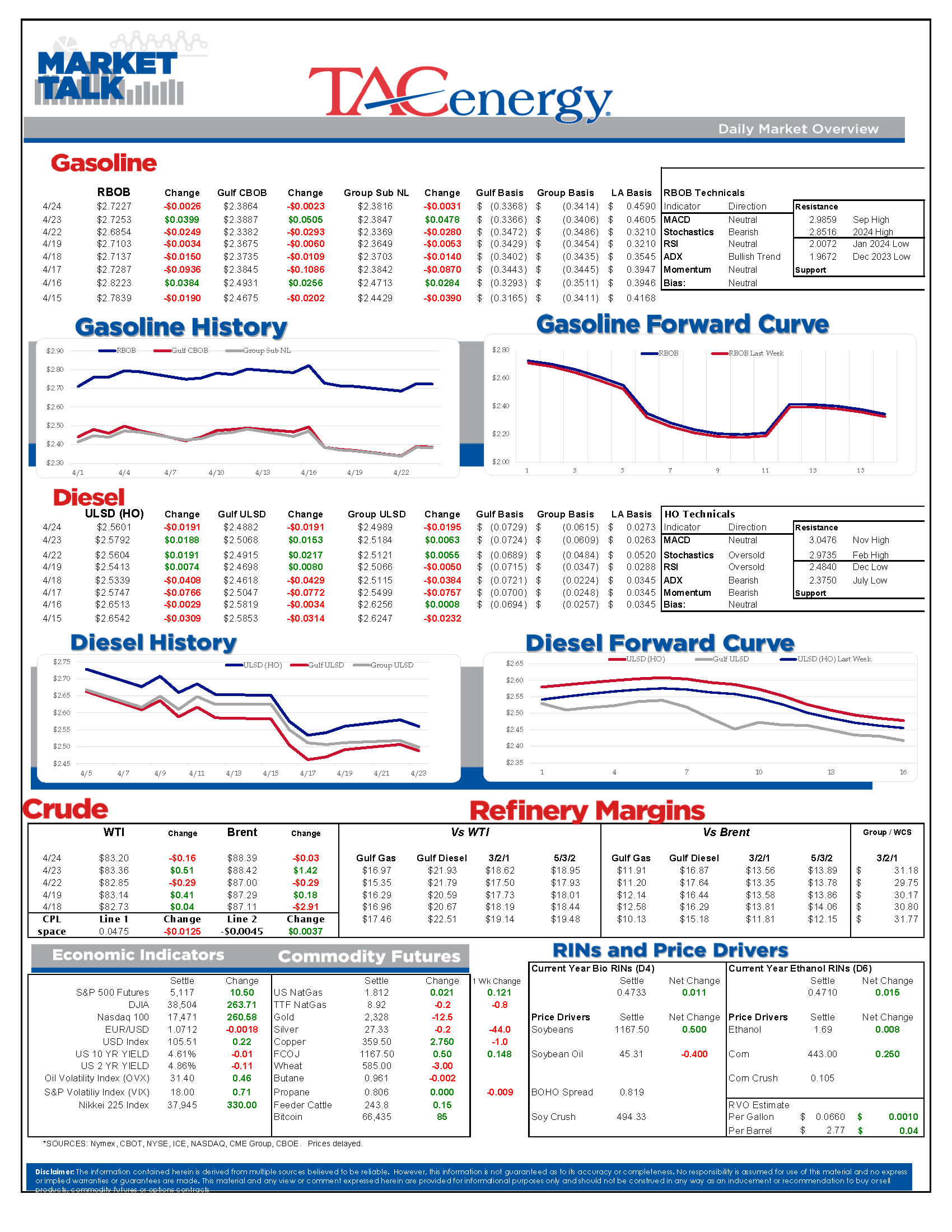

Energy Markets Trading Quietly In The Red As Ethanol Prices Rally To Five-Month High

Energy markets are trading quietly in the red to start Wednesday’s session after a healthy bounce Tuesday afternoon suggested the Israel-Iran-linked liquidation had finally run its course.

There are reports of more Ukrainian strikes on Russian energy assets overnight, but the sources are sketchy so far, and the market doesn’t seem to be reacting as if this is legitimate news.

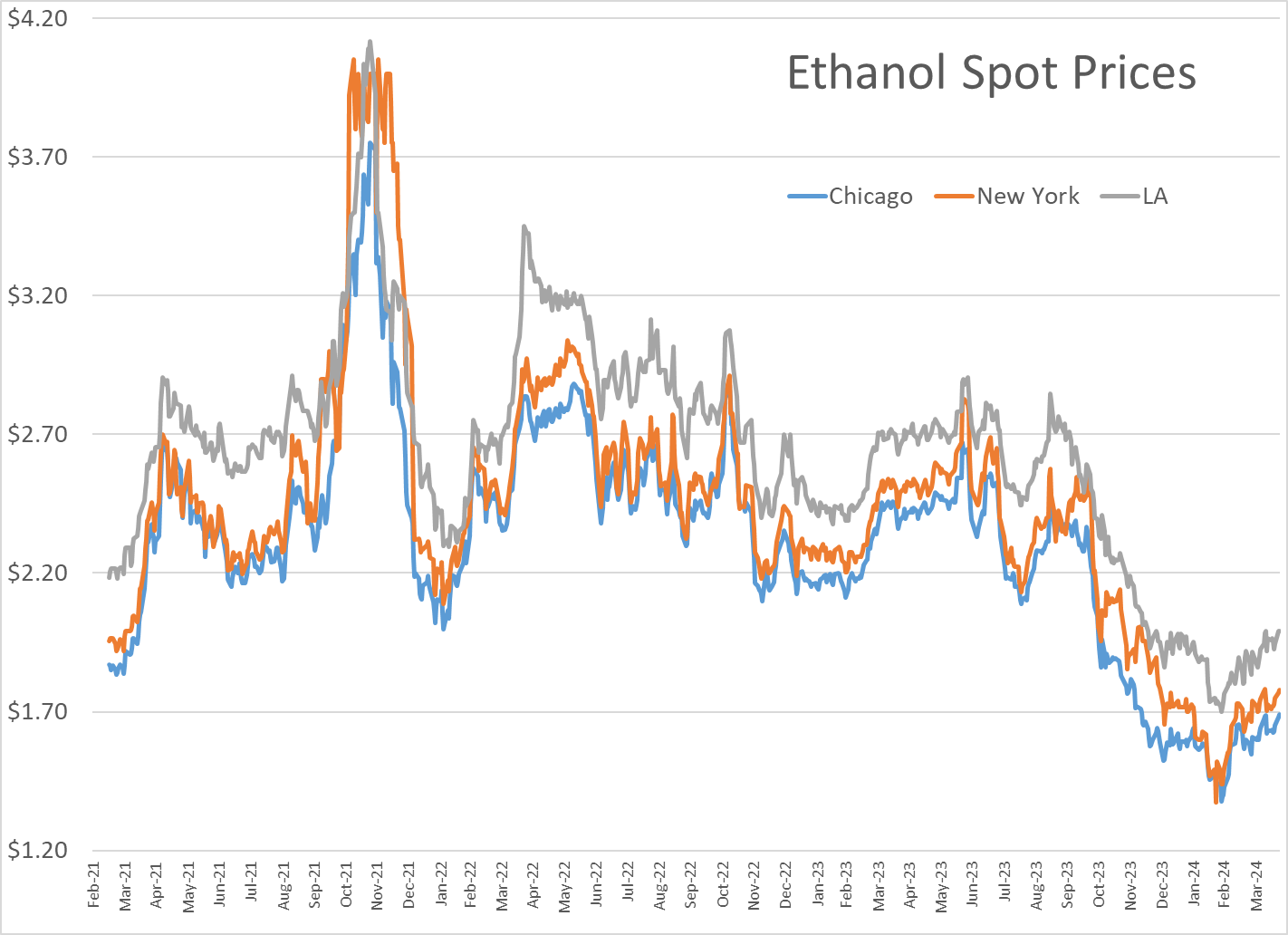

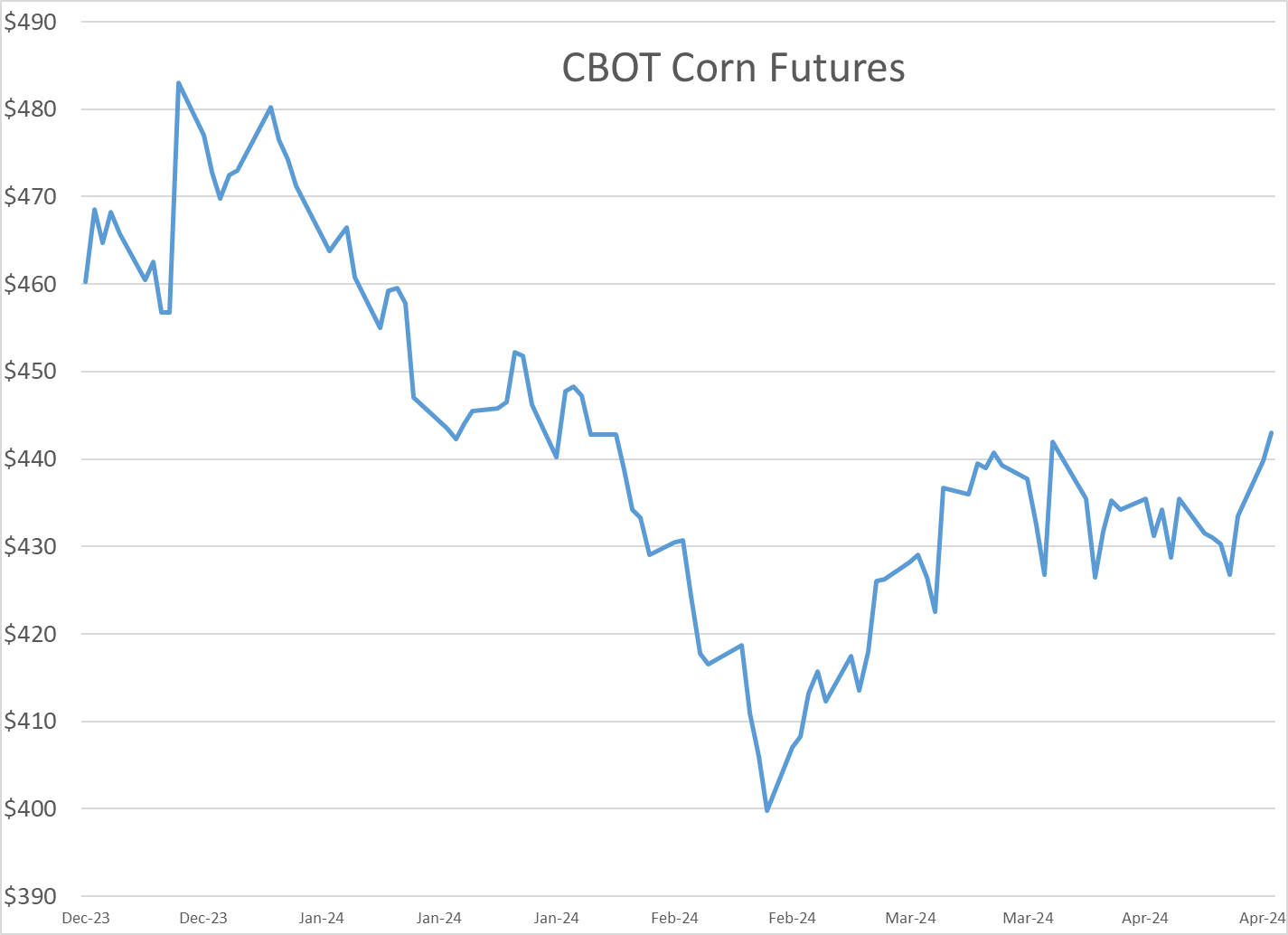

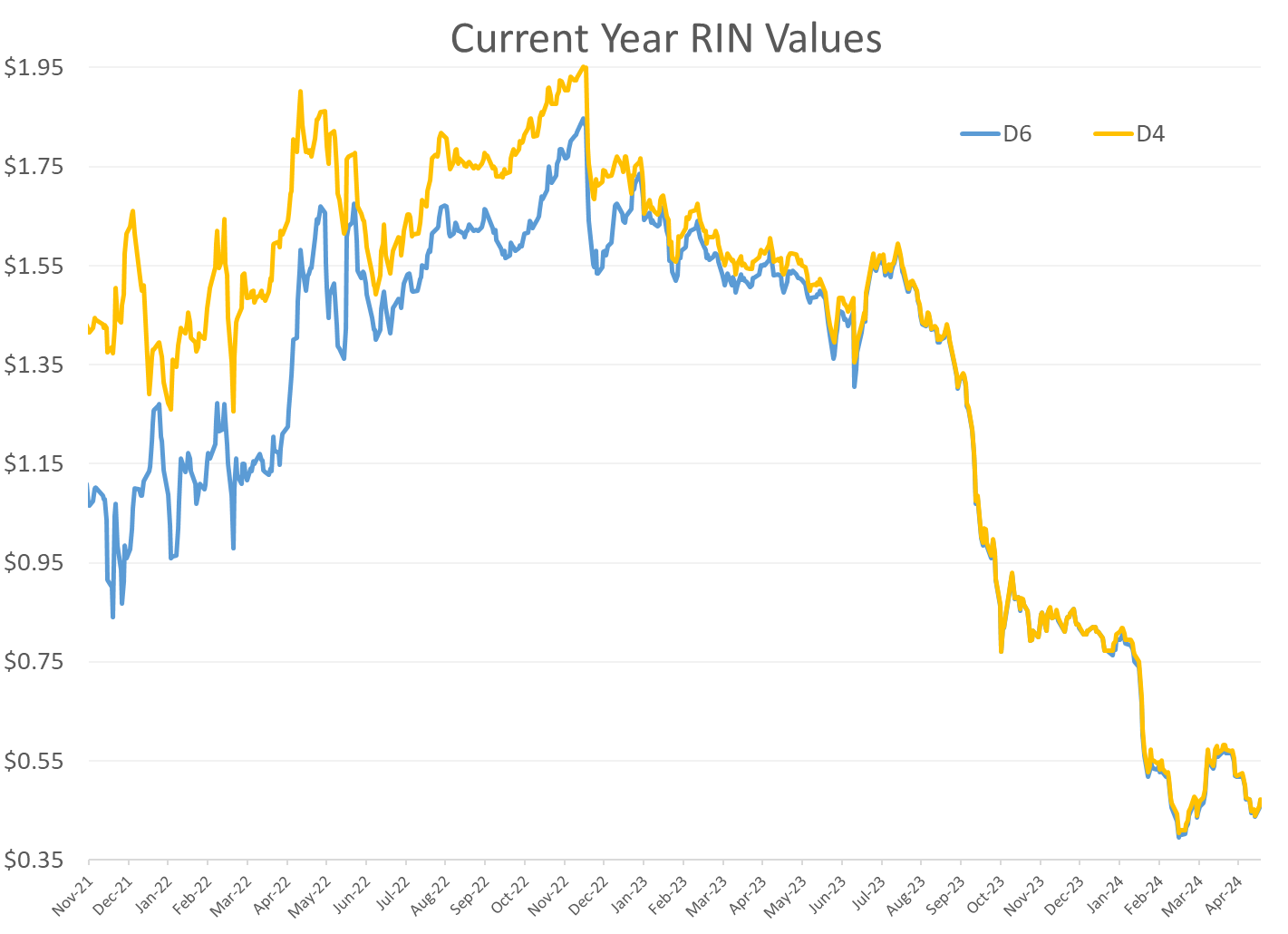

Ethanol prices have rallied to a 5-month high this week as corn and other grain prices have rallied after the latest crop progress update highlighted risks to farmers this year, lower grain export expectations from Ukraine, and the approval of E15 blends this summer despite the fact it pollutes more. The rally in grain and renewables prices has also helped RIN values find a bid after it looked like they were about to test their 4-year lows last week.

The API reported small changes in refined product inventories last week, with gasoline stocks down about 600,000, while distillates were up 724,000. Crude oil inventories increased by 3.2 million barrels according to the industry-group estimates. The DOE’s weekly report is due out at its normal time this morning.

Total reported another upset at its Port Arthur refinery that’s been a frequent flier on the TCEQ alerts since the January deep freeze knocked it offline and damaged multiple operating units. This latest upset seems minor as the un-named unit impacted was returned to normal operations in under an hour. Gulf Coast basis markets have shrugged off most reports of refinery upsets this year as the region remains well supplied, and it’s unlikely we’ll see any impact from this news.

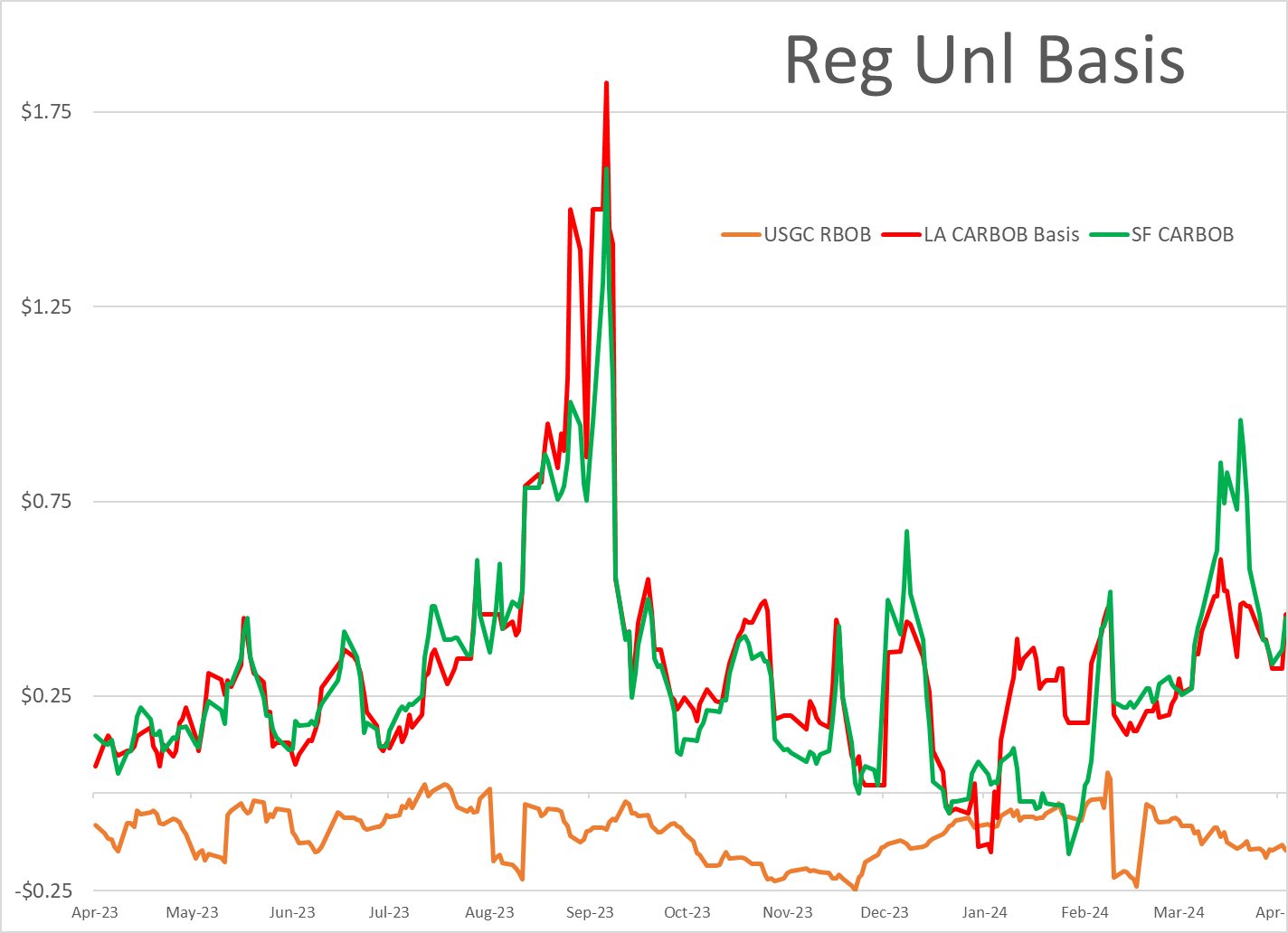

California conversely reacted in a big way to reports of an upset at Chevron’s El Segundo refinery outside of LA, with CARBOB basis values jumping by more than a dime. Energy News Today continued to show its value by reporting the upset before the flaring notice was even reported to area regulators, proving once again it’s ahead of the curve on refinery-related events. Another industry news outlet meanwhile struggled just to remember where the country’s largest diesel seller is located.

Click here to download a PDF of today's TACenergy Market Talk

News & Views

View All

ULSD Took A Week To Make A Move It Would Have Easily Made In An Hour 2 Years Ago

Energy markets are starting the week moving modestly lower with losses on either side of a penny/gallon for refined products. For ULSD, this would mark a 6th consecutive drop if prices stay negative today, with a total decline of 13 cents during that stretch, 11 cents last Monday/Tuesday and just 2 cents in the past 4 sessions. Another way to look at this, ULSD took a week to make a move it would have easily made in an hour 2 years ago.

While several analysts are suggesting the stock market may get a short term boost from the failed assassination attempt over the weekend, energy markets may be seeing a very minor reaction in the other direction as a Republican president would be more friendly to the industry, thereby allowing incremental supply to reach the market, which lowers prices and is actually bad in the short term for producers.

Hedge funds had mixed activity last week, adding modest amounts of length (bets on higher prices) in WTI, Brent and RBOB via a combination of new longs and some short covering, while the diesel contracts (ULSD and Gasoil) both saw modest reductions. WTI is seeing the most bets on higher prices from large speculators than we’ve seen all year, although it’s well below historical highs, and ULSD has stayed in net short territory for 6 straight weeks.

Baker Hughes reported a net decline of 1 oil rig and 1 natural gas rig active in the US last week, bringing the totals for both to fresh multi-year lows.

Total’s 200mb/day Pt Arthur TX refinery was taken offline Saturday due to a loss of steam, and the company expects flaring to be ongoing throughout the week as they attempt to bring the facility back online. There have not been any other refinery filings to the TCEQ the past 3-4 days, suggesting the restarts after Beryl moved through a week ago are progressing well.

Click here to download a PDF of today's TACenergy Market Talk.

Falling Gas Prices Have Not Been Good News For US Refiners

Refined products are attempting to find a floor after dropping by more than a dime in the first three days of the week. RBOB futures are trading modestly higher for a 2nd straight day, while ULSD futures are set to snap a 4-day losing streak.

Yesterday’s CPI report brought the first negative inflation reading for a month in 4 years, with lower gasoline prices the main contributor to the decrease. Stock market investors had mixed reactions to the report as the tech bubble looks like it may be starting to burst.

Falling gas prices have not been good news for US refiners that are seeing margins slide close to break-even levels at the time of the year that often brings their best profits. Crack spreads have recovered marginally in the past week but will still be cause for concern as summer starts to wind down.

Russian officials are recommending another ban on most gasoline exports as ongoing attacks by Ukrainian drones, and the upcoming peak demand season are creating concerns over domestic shortages.

Marathon was reportedly attempting restart at its Galveston Bay (FKA Texas City) refinery Thursday after Hurricane Beryl knocked out power to the facility and once again exposed weaknesses in the state’s power grid. A report Wednesday from the Dallas Fed discusses the challenges in meeting the state and country’s growing demand for electricity.

While Hurricanes are the most talked about threat to refineries, heat waves are becoming more of a concern, particularly in Europe as facilities are struggling to maintain steady rates as temperatures rise.

Click here to download a PDF of today's TACenergy Market Talk.

Refined Product Futures Prices Are Climbing Slightly Higher This Morning, Trying To Turn Today Into Reversal Thursday

Refined product futures prices are climbing slightly higher this morning, trying to turn today into Reversal Thursday and snapping this week’s downward trend. Diesel futures are leading the way higher, gaining 2+ cents to start the day while gasoline follows close behind, trading 1.5 cents over yesterday’s settlement.

The International Energy Agency published their monthly Oil Market Report early this morning, this week’s latest report from the industry’s sundry data reporting organizations affectionately known as Alphabet Soup. The IEA trimmed its oil demand growth forecast citing, generally, slowing global economic activity and, specifically, a decline in Chinese oil consumption. The Agency expands on the latter, attributing its lower demand expectations to factors like the looming real estate crisis in China and the country’s shift towards electric vehicles.

Power has been restored to the section of the Explorer Pipeline going from Houston to Greenville (North Texas) after being knocked offline Monday morning. Group 3 ULSD physical prices reacted promptly to the news yesterday, trading down to 14 cents below the screen. Outages persist in the Houston area where millions are still without power. Tracking said outages is, apparently, difficult for power providers, forcing some Texans to turn to a sacred regional chain for real-time information, adding to the host of reasons for it being the hometown favorite.

The Bureau of Labor Statistics came out with their monthly update on the status of inflation in the US, reporting that it slowed more than expected in June, dropping to 3% annually. While this may lead to the possibility of a rate cut in the near(ish) future, BLS also noted that the third consecutive month of higher unemployment could serve as harbinger for that nasty ‘R’ word.

Four days after making landfall on the US coast, the remnants of hurricane Beryl are still causing headaches, this time brining heavy rains and flooding to the North East. With pipeline outages and minimal refinery hiccups behind us, it looks like energy infrastructure is in the clear, for now, but the sudden appearance of tropical activity off the southern Atlantic Seaboard proves a stark reminder that there is more to come before the season is out.